Montana State Fund is reviewing policies which may have employees working solely to provide aid, comfort, or companionship to the policyholder or for a family member. In specific situations these types of employment are exempt from the Workers’ Compensation Act and an elective endorsement is required for coverage to extend to these employees.

Notification will be provided to policyholders that do not currently have the endorsement and appear to meet the necessary requirements for an elective endorsement. Policyholders will also receive notification that an endorsement is currently on their policy and is not necessary and will be removed.

In 2017, the Montana Legislature revised the definition of wages specific to the value of Workers’ Compensation lodging, rent, and/or housing (see MCA 39-71-123). The intent was to provide certainty for employees, employers, and insurers through application of a valuation methodology set by MT Administrative Rule (see ARM 24.29.721).

Effective April 1, 2018, the reportable value of housing was established for each county in Montana and published on the Department of Labor & Industry (DLI) website.

As of this date, all Workers’ Compensation Carriers in MT, including Montana State Fund, are required to apply the DLI employer provided housing values when calculating claim benefits and assessing policy premium.

For more information regarding these changes, please visit the

Department of Labor & Industry website. The website has valuable information on the changes and the current publication of the “Montana Workers’ Compensation Housing, Rent or Lodging Monthly Rates”.

The 66th Session of the Montana Legislature has adjourned Sine Die (fun fact: Sine Die is Latin for “without day.” In other words, indefinitely).

Now that the legislative session has concluded, we wanted to take this opportunity to say thank you to all the stakeholders who played a part in making this a successful session for Montana State Fund our policyholders and their workers. We could not do it without you.

This session was not unlike past sessions. We saw attempts to undo provisions of HB334 (2011), the bipartisan reforms that resulted in major rate decreases for Montana employers. We saw efforts to eliminate MSF and replace the guaranteed market with a high-risk mechanism, which may have resulted in double-digit rate increases for thousands of Montana employers. We saw efforts to assess a premium tax on MSF policyholders, 18,000 of which are the small businesses that make up the backbone of the Montana economy. None of these efforts were successful because stakeholders spoke together, in unison against those proposals.

MSF is Montana’s largest workers’ compensation insurance company, insuring approximately 24,000 Montana businesses and their workers. Our vision is to be an indispensable partner in achieving a safer, healthier and more prosperous Montana. By continuing to partner with agents, employers, employees and our stakeholders, we can accomplish this vision.

For your support and involvement, MSF thanks you

Combinable Risks – Past actions are not a guarantee of future actions, but they stand as a very good indicator. Why does this matter for Workers’ Compensation? Theoretically, owners run each operation in essentially the same manner. Employers looking for the cheapest and easiest way will likely continue down the same path in the future.

Common majority interest is the basic rule of combinability. When the same person, group of persons or a corporation owns a majority interest in multiple entities their loss experience is combined to develop a common (combined) experience modification factor. Majority interest is created when the same person or person(s) combined ownership is more than 50 percent of an entity. But majority interest can be determined in many ways. The National Council on Compensation Insurance (NCCI) lists the following:

- Majority of issued voting stock.

- Majority of the owners, partners or members if no voting stock is issued.

- Majority of the board of directors or comparable governing body if a. or b. is not applicable.

- Participation of each general partner in the profits of a partnership. Limited partners are not considered in determining majority interest.

- Ownership interest held by an entity as a fiduciary. Such an entity’s total ownership interest will also include any ownership held in a nonfiduciary capacity.

Regardless of how a group is created and combined, no entity’s experience will be used more than once. Without the ability to combine loss histories, workers’ compensation carriers would potentially be victims of inadequate premiums. Rate predictability and possibly rate adequacy may be compromised without combinability rules.

Please join Montana State Fund for our free half-day safety workshop, Fact and Emotion: The Basics for an Effective Safety Culture

OSHA Corner: The Occupational Safety and Health Administration (OSHA) institutes several safety standards and requirements that a business must follow. In this segment, we will discuss OSHA’s latest regulation changes and how they may affect your organization and employees.

Montana Safety Culture Act (MSCA): The MSCA turned 26 years old this year, but many Montanans are not aware of its existence, or what it means for our state’s employers and employees. In this session, we will review the requirements of the act, how it is being enforced, and the steps you can take to comply with it.

Leading a Safety Program with Emotion. For an organization to have a successful safety culture, leaders must be aware of their emotional intelligence (EI). EI is the ability to understand and manage your own emotions, and those of the people around you. For leaders, having emotional intelligence is essential for success. In this part of the training we will examine how your leaders can reach emotional intelligence to build an effective safety program.

Dates and Locations

May 30: Bozeman – Best Western GranTree Inn

June 5: Butte – La Quinta Inn

June 7: Great Falls – Holiday Inn

June 12: Glasgow – Cottonwood Inn

June 13: Miles City – Sleep Inn & Suites

June 14: Billings – Hampton Inn (3550 Ember Lane, just off of I-90 West)

June 19: Helena – Holiday Inn Express

June 20: Kalispell – Hampton Inn

June 21: Missoula – Best Western Grant Creek Inn

Interested? Register Now. The free trainings take place from 8:30 am – Noon. If you have questions, call 800-332-6102 extension 5361 (

Kirk Smith).

Whether you are new to the workers’ compensation industry or a 15-year veteran, Montana State Fund has a class that is the right fit for you.

Producer Academy: The “Producer Academy” is back for its 2

nd year. This class was designed to help our agents be the trusted advisor for their customers. It is perfect for agents who have been in the industry for a little while and want to sharpen their skills.

Introduction to Workers’ Compensation: The Introduction to Workers’ Compensation class is open to everyone, but is required for those who want to be recognized as an appointed agent with Montana State Fund. The “Introduction Class” was designed for the newest agents entering workers’ compensation but is detailed enough for even the seasoned veteran.

Below are the locations and dates for our next trainings. To register go to montanastatefund.com . I am an agent and then agent workshops.

Missoula (Wingate by Wyndham)

May 29 – Introduction to Workers’ Compensation (9 am – 3 pm)

May 30 – Producer Academy (9 am – 3 pm)

Billings (Homewood Suites)

July 9 – Introduction to Workers’ Compensation (9 am – 3 pm)

July 10- Producer Academy (9 am – 3 pm)

Bozeman (Homewood Suites)

September 10 – Introduction to Workers’ Compensation (9 am – 3 pm)

September 12- Producer Academy (9 am – 3 pm)

Missoula (Wingate by Wyndham)

November 5- Introduction to Workers’ Compensation (9 am – 3 pm)

November 6- Producer Academy (9 am – 3 pm)

By Mark Rosenleaf, Safety Management Consultant

Last quarter’s Safety Corner discussed the services our Safety Management Consultants (SMC’s) offer our policyholders and cited the teamwork that provides our mutual customers with the best product and service. But what if they don’t want to use those services?

You’ve probably got the skills and tools to help them see the light, but here are a couple more.

Studies show that the return on investment for investments in safety is somewhere in the range of 200% to 600%! The problem comes when your policyholder asks you to show them how they’re going to make or save $20,000 if they spend $10,000 today. It’s complicated, and not exact, but you can do it.

Here’s how:

Start with direct vs. indirect costs. Direct costs are the bills that they’ll see. Hospitals, doctors, work comp premiums, etc. Indirect costs are the ones they may not be aware of, and those can be twice the direct costs. These include time spent investigating; loss of production; loss of employee productivity; employee training; repairs; lower morale; absenteeism; reputation within the community, etc.

Take the cost of the medical bills for all the claims in a given period. Double that amount to get the indirect costs, then add those numbers together. It might be a lot of money.

Now consider that every injury, incident, near miss and unsafe act is an opportunity to put something in place to prevent the next one.

Your customers are likely already doing some things to enhance safety, even if they don’t think about it. Ask them to track their Leading Indicators – positive things they’re doing that impact safety.

These include training; reporting near misses; safety meetings & committees; housekeeping; maintenance and more. They should track, promote and celebrate these victories. These are the things that keep employees safe. Injuries are not necessary, and they shouldn’t be a cost of doing business. Zero is possible.

Tell them to think of safety not as an expense, but as a profit center that must be managed just like any other aspect of their business.

We wish a fond farewell to a member of our Marketing Team, Heather Domme, as she moves on to other exciting opportunities. Heather has made significant contributions to the success of MSF’s marketing program. We will miss her contributions, talents, and winning personality. We wish her well in her new position and are confident that she will succeed where ever she goes. Good Luck, Heather!

All marketing requests should now be forwarded to Nick Hopkins, Director of Marketing and Business Development. He can be reached at 406-495-5435 or

nhopkins@safemt.gov

Changes in Payroll Reporting

EMPLOYEE HOUSING – As part of the items that constitute earnings, there has been a slight modification effective 4/1/18. Included in earnings is the actual value of any substitutes for monetary payments, including but not limited to, meals and lodging, value of rent or housing, store certificates, merchandise and credits. Effective 4/1/2018 the reportable value for housing is established for each county in “Montana in the publication entitled Montana Workers Compensation Housing, Rent or Lodging Monthly Rates” available at the Department of Labor’s website at

http://erd.dli.mt.gov Agricultural employers may discount the published housing by 50% for the county in which the dwelling is located.

For further information contact the Montana Department of Labor.

NEW ENDORSEMENT – WC 00 04 14 A

90-DAY REPORTING REQUIREMENT-NOTIFICATION OF CHANGE IN OWNERSHIP ENDORSEMENT

On November 9, 2018, NCCI issued an endorsement requiring employers to report changes in ownership to their insurer in writing within 90 days of the date of the change. The endorsement states in pertinent part:

You must report any change in ownership to us in writing within 90 days of the date of the change. Change in ownership includes sales, purchases, other transfers, mergers, consolidations, dissolutions, formations of a new entity, and other changes provided for in the applicable experience rating plan. Experience rating is mandatory for all eligible insureds. The experience rating modification factor, if any, applicable to this policy, may change if there is a change in your ownership or in that of one or more of the entities eligible to be combined with you for experience rating purposes.

Failure to report any change in ownership, regardless of whether the change is reported within 90 days of such change, may result in revision of the experience rating modification factor used to determine your premium.

This reporting requirement applies regardless of whether an experience rating modification is currently applicable to this policy.

The endorsement has been approved by Montana State Auditor’s Office and will be included in the January Renewal Packets generating this week for Select Policies.

In September, the Montana State Fund (MSF) Board of Directors declared a $40M dividend to be paid to qualifying policyholders. Payment of the dividend is now complete.

A dividend is never guaranteed from year to year. If circumstances warrant, the board can choose to not declare a dividend or declare a smaller dividend. However, this marks the second consecutive year the Board has declared a $40M dividend and brings the total amount returned to policyholders since 1999 to $256M. This year’s dividend is equivalent to an average return of 28.4% of premium for those receiving a dividend. The average payment is $1,728.

In addition to providing dividends as a return of premium to our customers, MSF has reduced premium rates or held the rates steady every year since 2007. Since July of 2007, premium rates have been reduced 42% and are currently at the lowest level since the creation of the Montana State Fund in 1991.

Our agent partners are certainly a major component in the recent successes of MSF. Please let us know if you have any questions or comments on our dividend program.

As many of you are aware, Montana State Fund launched a rebrand last Spring. With that came a refreshed

mission, vision, values, and redesigned logo.

Our new logo is now blue and highlights the word Montana in our name. In addition, we cut the diamond that formerly surrounded the SF, which gives it a freer flowing feel.

If you have any materials that use our old logo, or you post our logo on your website, please update it with our new logo.

Click to access our logo library If you need help in updating any materials or replacing the logo, please contact MSF Communications Manager

Mary Boyle.

We are excited about this brand refresh and look forward to continuing our partnership with you to make Montana a safer, healthier, and more prosperous to place live.

Montana State Fund recently hosted the 12th Annual CSR / CSS Conference at the Great Northern Hotel and Conference Center in Helena.

This event offered the Policy and Billing Replacement Initiative (PBRI) Team an excellent opportunity to introduce the development effort of the new system to customer service representatives (CSR’s) from MSF’s partner agencies across the state. This was their first exposure to an early look and feel of MSF’s state-of-the-art policy management system which is due to “go-live” in the last quarter of 2019.

MSF’s customers have been, and continue to be, consulted on their needs for what the new system should do and how it should perform. At this event, CSR’s were invited to share their views on MSF’s service delivery, using the current system.

CSR’s responded with their highest level of dissatisfaction being the responsiveness and cost effectiveness of the current system. Both of these criteria hinder their ability to be “brilliant in the moment” with their own customers.

CSR’s expressed their highest level of satisfaction as being their relationship with MSF staff. The way MSF staff provides support, is courteous, communicates in a caring manner, and their competence were all areas that received high ratings.

The PBRI Team demonstrated some of the most recently developed functionality and features of the new system. Improved efficiencies, convenient and quick access to information, and making work easier for MSF’s customers are some of the key requirements driving the system’s design.

A short video provided a ‘behind-the-scenes’ look into how the project is working. MSF’s CEO and President, Lanny Hubbard delivered an important message (view the video)

Lynn Mogstad, Business Unit Director and conference organizer, said: “Appointed agencies from across the State send their CSR’s to attend this event. CSR’s are the face and voice of their agencies. This is the one time of the year where our external CSR’s and internal customer service specialists (CSS’s), who are the face and voice of MSF, have an opportunity to network, learn, and discuss matters of mutual importance.”

We are happy to introduce a number of new employees to the MSF Team. In the past few months we added five Customer Service Specialists, six Claims Examiner Trainees, a Safety Management Consultant and an Underwriter. These team member look forward to working with you to ensure our customers have an exceptional customer experience.

These new employees include:

Customer Service Specialists

Travis Brower

Brenna Burgos

Marika Davis

Amanda May

Glen Grover

Claims Examiner Trainees

Jenni Grovom

Layla Bullington-Hines

BriAnne King

Andrew Pitsch

Clare Stiennon

Shelley Widhalm

Safety Management Consultant (Kalispell)

Tim Mayhak

Underwriter

Amber Jellison

The Economic Affairs Interim Committee is wrapping up its study (SJR 27) of the Montana workers’ compensation system and MSF structure. One meeting on SJ27 remains in September.

Over the past year and a half, the Committee—made up of four democrats and four republicans (two of each from each chamber)—has heard from industry experts from across the country as well as Montana stakeholders. MSF has consistently held the position that we believe the current structure of a competitive workers’ compensation system is the best for Montana businesses and their employees – especially small businesses that have fewer market options. It is MSF’s position that over the course of the study, the facts and data have proven this to be the case.

Based on the facts and data presented to the committee, various alternative concepts have been withdrawn from consideration. For instance, a competing concept was to eliminate MSF altogether and replace the guaranteed market with a high-risk pool. Despite unfounded claims to the contrary, MSF was able to produce data showing that under a high-risk pool scenario, many of Montana’s small businesses would see rate increases. For this reason, and others, the committee opted to abandon the “elimination” option.

Current committee efforts are focused on making MSF look and operate more similar to a private insurance company. There are a few pieces of committee draft legislation in the works to accomplish these efforts:

- MSF exemption from the Montana Information Technology Act (MITA).

- Allow the State of Montana to explore a bidding process to cover state employees for workers’ compensation (exempting the university system and MSF).

- MSF exemption from state procurement.

- Election of a minority of MSF board members by MSF policyholders.

We have not yet seen final language on any of these proposals. Therefore, MSF does not at this time have an official position on them. However, we can tell you that conceptually these are very similar to how private companies do business and certainly could go a long way to level the playing field.

If you have any questions, please do not hesitate to reach out to one of your customer service specialists at 800-332-6102. It is our goal to help you better inform your customers—our policyholders.

Over the years, Montana State Fund has been dedicated to providing exceptional trainings for our incoming agents and CSR’s. All new agents are required to attend a Producer Training before they can begin writing business with MSF. However; all agents, from the beginner to the experienced, are welcome to attend. Everyone benefits from this 50,000 feet view of workers’ compensation.

We will be offering this training again this fall in three locations: Billings, Missoula and Helena. Please mark your calendars – registration will open soon.

Producer Training 101 – an introduction to Workers’ Compensation

October 18 Billings – Double Tree

October 23 Missoula – Wingate

October 29 Helena – MSF

We are excited to announce that a more advance training is coming your way! This is not a required training, but we encourage all folks to attend. This training will focus on more advance technical topics and naturally build on the skills that you learned in our 101 training. The structure will remain the same, covering safety, claims and policy. We want you to be the expert!

Producer Training 201 – Becoming your policyholders Trusted Advisor

October 19 Billings – Double Tree

October 24 Missoula – Wingate

October 30 Helena – MSF

If you have any questions about the trainings contact

Heather Domme at 406-495-5455.

Did you know that you can send your servicing team new applications, change requests, and policy questions through email? For Select team policies (under $15,000 in manual premium) email

stfselectcss@mt.gov. For Premier team policies (over $15,000 in manual premium) email

stfcsspremier@mt.gov.

Since these emails are monitored all day long, this is our preferred method of communication rather than emailing an individual who may be unexpectedly out of the office. When sending a change request or question, please include the policy name and number in the subject line.

You can also avoid mailing new application down payments by conveniently paying

on line. To submit, go to

montanastatefund.com. On the right hand tab click online payment, then choose Make a One Time Payment.

We are pleased to host our annual CSR – CSS Conference. This two-day event is a wonderful opportunity for our Customer Service Specialists and our agency Customer Service Representatives to learn and share from one another.

Day 1 – Monday, October 1, 2018

9:00 a.m. – 11:00 a.m. Workers’ Comp 101 (Location – Montana State Fund)

11:30 a.m. Welcome Lunch (Location – Great Northern Hotel)

12:45 p.m. – 5:00 p.m. Continuing Education (Location – Great Northern Hotel)

* Common Class Code Misconceptions

* Policy and Renewal Essentials

* MSF’s New Policy and Billing System Preview

* MSF’s Rebrand and the Customer Experience

6:00 p.m. Dinner at the Great Northern Hotel

Day 2 – Tuesday, October 2, 2018

7:30 a.m. Continental Breakfast (Location – Great Northern Hotel)

8:00 a.m. – 12:15 p.m. Continuing Education (Location – Great Northern Hotel)

* Ethics

* Workers’ Comp Claims

* Cyber Security

* Safety in the Workplace

We look forward to another productive conference. If you have questions, please contact

Heather Domme (406) 495-5455.

MSF has reduced the account size required to qualify for an exception to the system assigned rate tier for new policies and for PY17 and PY18 renewal policies. If the account qualifies, MSF will manually calculate the rate tier to consider private carrier data or a combination of private carrier and MSF data.

Beginning 7/1/18, MSF will override the system assigned rate tiers if the new or renewal business meets all the following required conditions:

• The account must have 3 years of continuous coverage (i.e. 36 consecutive months counting backwards from the proposed effective date). The coverage must be continuous, but can be obtained through private carrier data only or a combination of private carrier data and MSF data.

• The new business account must be experience rated. The submission must contain the current experience modification worksheet or an authorization letter for MSF to obtain it.

• The account’s premium must be at least $5,000 as calculated by MSF3 (rate tier) multiplied by the experience modification factor. Previously, MSF required the minimum account size to exceed $15,000.

• The new business account must provide at least 3 years of currently valued loss runs with the submission.

All changes are calculated and approved by MSF prior to binding coverage. You may choose to send us the required information at any time

prior to the effective date of the policy for our review and potential price adjustment.

If you have additional questions, please call

Nick Hopkins, Director of Marketing and Business Development at (406) 495-5435 or

Heather Domme, Marketing Service Specialist at (406) 495-5455.

MSF is approximately half-way through the development of the new policy and billing system. Erika Ayers, project manager, has the following to say:

“Although a lot has been completed and achieved, there is still a substantial amount of work left to do.”

“We constantly remind ourselves that this is a long-term, complex system being delivered and we are mindful that we need to keep our customers informed. We plan to send out regular communications to keep our customers up to date on latest news and development of the system.”

“In addition to the policy and billing components which MSF will be using, we are also building the access portal, through which agencies will interact with MSF. The most significant change for agents is going to be access to information.”

Some of the functionality that has been developed and that the team is currently working on includes:

- The ability to submit applications online.

- To offer multiple options of how a policy can be structured, such as,

- Account : Policy

- Account : Multiple Policies

- Account: Policy with multiple legal entities (under evaluation)

- The capability to make some policy updates online

- To provide agencies with access to billing information including:

- Billing/Payment History

- Current Amount Due

- A “Quick Quote” tool

“Although our ‘Go-Live’ date is at least a year away, MSF is starting to address training plans. Training will be provided to MSF’s staff and, as agencies are a key component of our plans, MSF will be identifying and meeting customers’ needs.”

“Customers are also regularly consulted for their input on features and tools that they would like to see in the new policy and billing system.”

MSF leaders, staff and the PBRI project team care about our customers’ and have a desire to help them by delivering a new policy and billing system that meets their needs.

For the last eighteen months, we have been collecting your ideas on how to find a better way to work together. We have used those suggestions to guide our efforts to improve the ease of doing business with Montana State Fund. This is a summary of MSF’s newest procedures resulting from that work.

Secretary of State Registration

- Quotes can now be created without verification of registration with Secretary of State.

- Policies without registration can be bound as either a sole proprietorship or partnership.

- Unfortunately, all other policies must be registered for enrollment. If the policyholder is not a viable approved business, it is difficult to collect unpaid premium after default.

WOS – Waiver of Subrogation

- Our questionnaire is no longer required nor are there additional questions. We have simplified the process to require only minimal information. The only information required is entity name, mailing address and the effective date of the waiver.

CCA – Construction Credit Application

- We no longer require an owner’s signature. Any authorized signature will now be accepted.

- Our CSSs will now call for clarification on applications where information is needed.

- We have created a dispute resolution process if the dispute is received within 60 days of determination.

Prior Policy

- Quotes can now be issued with prior unreconciled policies; enrollment will still require reconciliation.

Reinstatements

- We now allow 2 reinstatements (versus one) within policy year.

- We will automatically reinstate a policy if overdue premium or payroll reports are received within 5 days of cancellation. Under these circumstances, we will reinstate an unlimited number of times (and they don’t count towards your 2 reinstatement limit above.)

Rate Tier Exception (effective 7/1/18)

- Rate Tier Exceptions are now possible for policies as low as $5,000.

- In order to qualify for this consideration, the account must have 3 years of continuous overage.

- It must be experience rated.

- The account premium must be at least $5,000 as calculated by MSF3 rate tier.

- If the account qualifies, MSF will manually calculate the rate tier. The exception can only lower the rate tier. Information submitted for consideration that increases the rate tier will be ignored.

Many employers use independent contractors to reduce the cost of their workers’ compensation insurance. However, simply calling a worker an independent contractor does not make them so and mistakes identifying them as such can be expensive. If your client hires a contractor without an effective Independent Contractor Exemption Certificate (ICEC), their wages will be added to their policy at audit and premium charged in full. Also, all losses resulting from the injury of these workers will count towards adverse experience on their work comp policy and increase their work comp policy at renewal. The unexpected expense can be tragic.

You can help your policyholder avoid unplanned liability by advising them to carefully handle how they hire and supervise independent contractors.

To qualify as an independent contractor in Montana, a worker must be:

- Free from control or direction.

- Engaged in their own independently established business, occupation, trade or profession.

- Hold an effective ICEC.

The Montana Supreme Court has stated the following four factors are indicators of control in a working relationship:

- Evidence of control, including the right to control their daily activities.

- Furnishing of the worker tools and equipment for the work.

- Paying for the work in ways that show an employer/employee relationship.

- Have the right to fire at will (without contractual liability).

Independent Contractor Exemptions

Owners of a business that consider themselves independent contractors MUST either have workers’ compensation coverage on themselves or obtain an Independent Contractor Exemption Certificate. When approved, the ICEC exempts an individual from both workers’ compensation and unemployment insurance. A sole proprietor, working member of a partnership, member managed limited liability company or manager managed limited liability company (construction industry) may apply for the exemption.

For more information about Independent Contractors and the ICEC go to the

Montana Department of Labor website here.

Customer Service has always been important at Montana State Fund. It’s one of our core competencies and has been part of our mission statement for years. Just as we’re refreshing our brand, we’re also refreshing our strategy on customer service. Our focus now is the Customer Experience, or CX as it’s commonly known.

The distinction between Customer Service and CX lies in looking beyond individual transactions, and instead concentrate on the customer’s entire journey with us. Exceptional service means providing superior guidance and assistance each time we interact with the customer, whether verbally, in writing, though advertising, or on our website. An exceptional Customer Experience is all of those touchpoints put together from the customer’s very first encounter with us to their very last – their end to end journey.

Montana State Fund introduced the concept of CX last fall with a week-long celebration. The theme of our celebration was

The Customer Experience – Together We Complete the Puzzle. The goal of the week was to help MSF staff recognize the role we all have in the CX puzzle. The celebration focused on education of the foundations of service, with a different theme each day, including quizzes and prizes. We also had interesting and motivational signage throughout the building, as well as fun games and rewards, all in keeping with the theme. It was a great week with long lasting take away moments. However, our focus on CX didn’t end there.

Current efforts to increase CX include:

- Focus on ease of doing business

- Emphasize our competitive place in the market

- The Policy Billing and Replacement Initiative (PBRI)

- MSF brand refresh

- Changing the vernacular during every day interactions with staff and strategic partners to highlight and embrace the term Customer Experience and what it means

Additional ideas MSF is researching include:

- CX onboarding for new employees

- Classroom and online CX training

- Leadership CX training

- Making the week-long celebration an annual event

At Montana State Fund we understand all of us impact our customers’ experience. We also understand our customers are all around us: from our co-workers, to our policyholders and injured employees, to our strategic partners in agency offices all over the state. We look forward to the opportunity to work with you to strengthen your, and your client’s, Customer Experience!

It was the culmination of nearly a year, but on April 30, MSF employees kicked off our brand refresh celebration. With the kick off came a refreshed mission, vision, guiding values and logo.

These new elements were created by our employees, for our employees and customers. The new brand refresh is the promise that we make and the reflection of everything we do, everything we say, how we say it and how we do it. It’s our reputation, both in the services we provide and as an employer. It will serve as a guide for the decisions we make, and for our own behaviors as individuals, as teams and as an organization.

Our Mission

We partner with employers and their employees to care for those injured on the job and we champion a culture of workplace safety for our fellow Montanans.

Our Vision

To be an indispensable partner in achieving a safer, healthier and more prosperous Montana.

Our Six Guiding Values

Do what’s right

Deliver with heart

Focus on what matters

Succeed together

Find a better way

Take the long view

In addition, we refreshed our logo. We replaced the teal color with fresh blues, and highlighted the word Montana in our name. We also eliminated the diamond that formerly surrounded the SF, which now gives it a freer flowing feel.

We hope to have all of our forms, online materials etc. updated with our new look and feel by December 31, 2018. In the meantime, if you have any materials that use our old logo, we are happy to update them for your or we can send you the appropriate formatted logos. Please contact

Heather Domme with your changes.

We are excited about this brand refresh and look forward to continuing our partnership with you to make Montana a safer, healthier and more prosperous to place live. Because everything we do together, does more.

Montana State Fund is pleased to host our annual CSR – CSS Conference. This two-day event is a wonderful opportunity for our Customer Service Specialists and our agency Customer Service Representatives to learn and share from one another.

Day 1 – Monday, October 1, 2018

9:00 a.m. – 11:00 a.m. Workers’ Comp 101 (Location – Montana State Fund)

11:30 a.m. Welcome Lunch (Location – Great Northern Hotel)

12:45 p.m. – 5:00 p.m. Continuing Education (Location – Great Northern Hotel)

* Common Class Code Misconceptions

* Policy and Renewal Essentials

* MSF’s New Policy and Billing System Preview

* MSF’s Rebrand and the Customer Experience

6:00 p.m. Dinner at the Great Northern Hotel

Day 2 – Tuesday, October 2, 2018

7:30 a.m. Continental Breakfast (Location – Great Northern Hotel)

8:00 a.m. – 12:15 p.m. Continuing Education (Location – Great Northern Hotel)

* Ethics

* Workers’ Comp Claims

* Cyber Security

* Safety in the Workplace

We look forward to another productive conference. If you have questions, please contact

Heather Domme (406) 495-5455

Congratulations to Deb Brotherton for her promotion to Customer Service QA Specialist/ Underwriter 1.

Deb has 26 years of underwriting experience, both with MSF and other workers’ compensation carriers. She has served in the quality assurance role for 4 years, assisting our Customer Service Specialists with a variety of technical questions and issues.

In her new role, Deb will join the underwriting team and report directly to Suzie Shute. She will also continue to ensure the quality of services provided to customers and agents by our customer service specialists.

Please join us in congratulating Deb on her promotion.

In November 2017, Governor Bullock called a special session of the Montana legislature to address a large budget shortfall caused by declining revenues and a historic fire season. In his proclamation, the Governor outlined several proposals to address those budget issues.

One of those proposals became Senate Bill 4 (SB4), an act providing for a 3% management rate on certain portfolios managed by the Board of Investments (BOI). The criteria applied only to accounts with an average asset balance in excess of $1B

and the average asset balance must have contained sufficient funds to offset all liabilities as determined by the most recent actuarial study. Montana State Fund’s (MSF) asset portfolio is the only portfolio managed by BOI that met the required criteria, resulting in a $30M fee being assessed on MSF’s policyholder equity. That fee will be payable in two payments—approximately $15M in 2018 and $15M in 2019.

MSF initially challenged the legality of SB4, filing a complaint in District Court the day after passage. The MSF Board of Directors later reconsidered the action and withdrew the complaint citing concern of the optics surrounding the challenge and expressing a desire to work with the legislature and elected officials.

Following the dismissal of the MSF complaint, a group of policyholders filed a complaint for declaratory judgment in the 20

th Judicial District Court in Polson. The policyholder complaint seeks to invalidate SB4 based primarily on constitutional grounds.

AS IT PERTAINS TO MSF POLICYHOLDERS

SB4 mandates that MSF cannot consider the assessed management fees when determining the rates charged to policyholders or in declaring a dividend. By law, dividends cannot be guaranteed. They are the result of strong financial performance, the board of directors’ discretion, and each policyholder’s safety record. Dividends may still fluctuate based on other factors, such as the safety experience of a specific organization but cannot consider the impact of SB4.

Since 1999, MSF has returned more than $216M to policyholders through our dividend program. Doing so allows MSF to incentivize safety in the workplace. The $40 million dividend declared and paid in 2017 was a 28% return of premium to those 23,000 policies receiving the dividend. MSF’s dividend program remains unchanged and MSF remains a financially strong organization despite the passage of SB4.

QUESTIONS?

If you or any of your policyholders have questions regarding this matter, please do not hesitate to contact the MSF legal department at (406) 495-5201 or

kgowen@montanastatefund.com.

We have made a minor change to the POR letter. At times the signature is illegible, and our CSS’s are unable to read the owners name. The new revision adds a line after the existing signature to also print their name. Please update your documents to have the new POR letter on file. This new form, approved by the Montana State Auditor’s Office, will replace the old form which will no longer be in use.

Please download the new

POR Letter and save it for your records. You can also access the letter on our agent portal under documents and forms.

Thank you for your understanding. If you have any questions, please contact your Marketing Department.

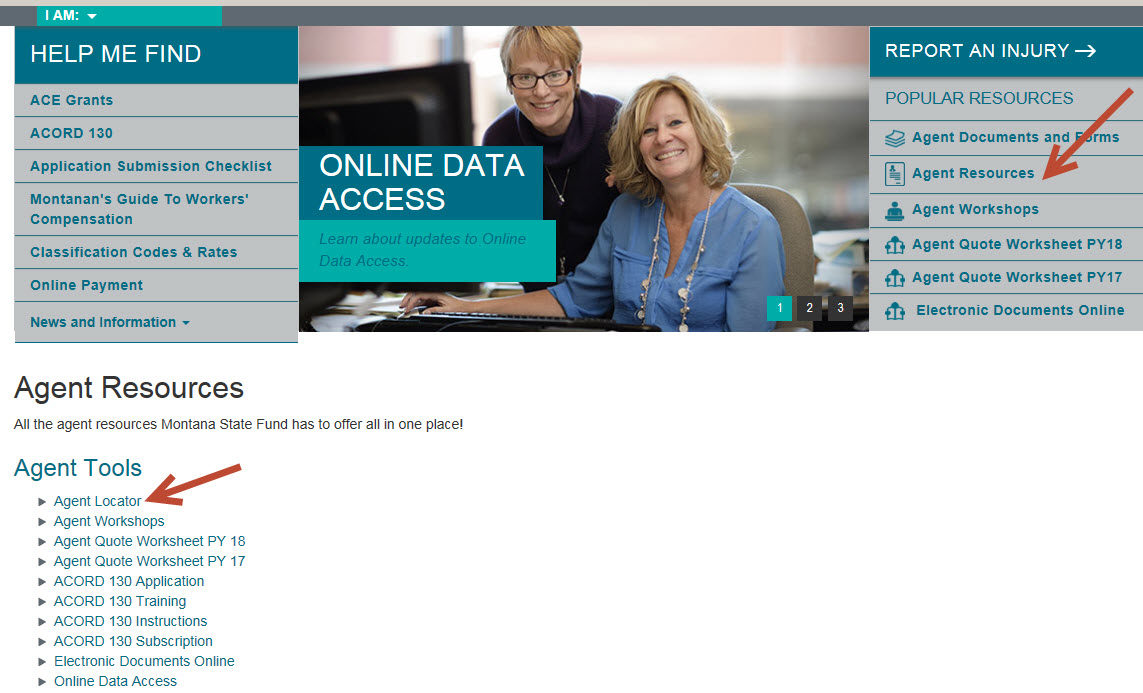

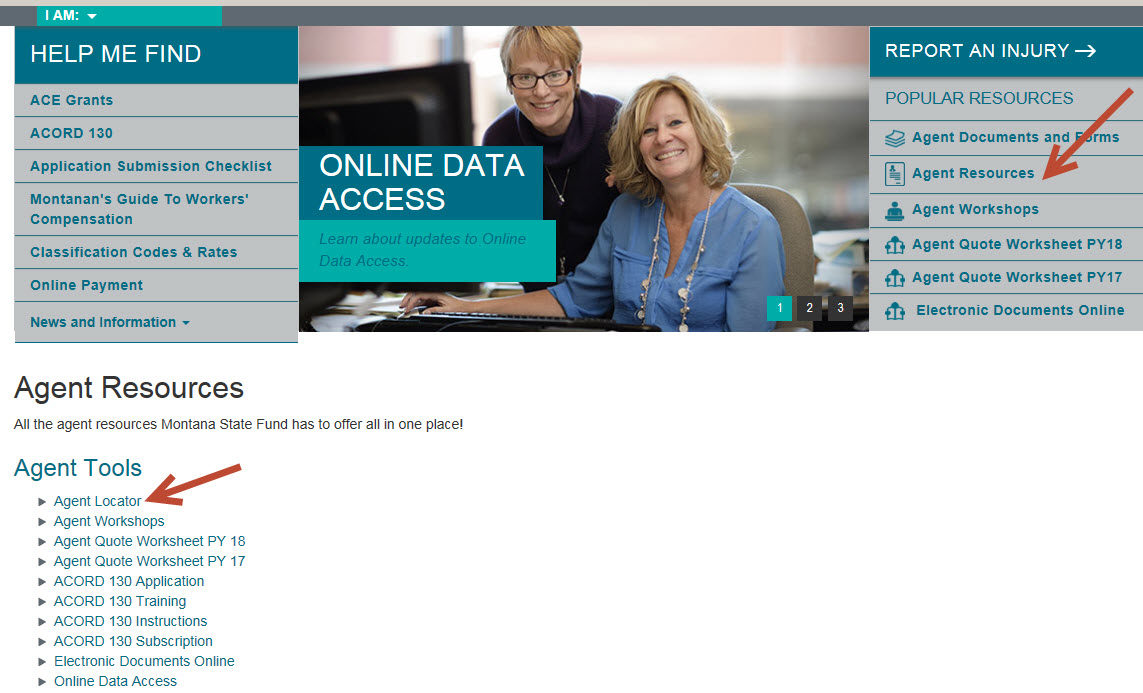

We have updated the Agent locator on the MSF Portal. This is a place where potential policyholders, and current policyholders, can go and view appointed agencies within MSF. All addresses should be correct, and all agencies are listed in alphabetical order.

We have laid out the page in three columns so more names can be visible at first glance. We have also attached a link to the agencies websites for easier access to company info.

You can view the

Agent Locator by clicking on “

I am an Agent” in the drop down. Then Click: “

Agent Resources” Under Agent Tools, you will find the locator. You can view agencies by city.

If you have any questions, please reach out to the MSF Marketing Department.

Montana State Fund invites you to attend our next producer training class. For your convenience, we have scheduled classes in Billings, Missoula and Helena. We have updated the curriculum. It will continue to provide the most up-to-date information about workers’ compensation coverage, but with a refreshed approach.

All new agents are required to attend a producer training before they can begin writing business for MSF. However, anyone can attend to refresh their workers’ compensation knowledge and skills.

Producer Training Sessions

Helena – April 19, 2018

Missoula – April 24, 2018

Billings – May 3, 2018

To sign up, please go to the Montana State Fund

agent portal.

*Training begins at 10 in the morning and continues until 3:30 pm and lunch will be provided. This training is approved for 5 continuing educational credits.

More Advanced Training Coming Soon

Our team is also developing a more advanced elective training curriculum. This training will target agents that have been in the industry for a few years. It will focus on more advanced technical topics and naturally build on the skills that you learned in your initial producer training. Training dates and locations will be announced as soon as the training is available.

“Our purpose is to find ways that make life easier for MSF staff, enhance the ease of doing business for MSF business partners, and create a ‘wow’ factor in the customer experience for policyholders,” says Theresa Bonin, lead analyst for Industry Research.

“Any time an organization experiences a major change, there’s a great opportunity to pull up and take a look at how we’re doing business and why we’re doing things the way that we are. MSF wants to be a differentiator in the marketplace and putting a new system in place, like the new Policy and Billing system, creates the perfect opportunity to be innovative” says Bonin.

The words ‘best practices’, ‘industry best practices’, and ‘industry research’ have been resonating around the PBRI project office for a while. Bonin clarifies this effort: “what we’re doing is “Industry Research”. In essence, it means that we get to understand what other carriers are doing and introduce what makes sense for MSF. Our research helps MSF to choose and adopt more widely accepted business processes that are a best fit for the organization. Using the platform created by the new policy and billing system, improved business processes are a leverage to enhance MSF’s customer experience, at the same time making life easier for MSF staff.”

Currently there are 10 key focus areas that have been identified for industry research but Bonin is calling for more “No one knows the customer better than the front line staff. If you have ever wondered why you are doing something, keep hearing customers complain about a certain process, or have an idea on how to do something more efficiently and effectively – please don’t be shy…come share your thoughts.”

Simply put, the way that this process works is as follows:

- A Research Request is registered.

- A set of questions is established.

- Industry research is conducted by talking to industry contacts, review what other workers’ compensation carriers (peer and national) are doing in the marketplace, Agency Partner Council members (APC), and industry analysts.

- Information and feedback is collected and analyzed.

- Recommendations, based on ‘best fit’ to MSF and the new policy billing system, are presented to the PBRI Executive Sponsors. ‘Best fit’ is a balancing act between doing business more efficiently, more effectively, and ensuring regulatory compliance.

- When a recommendation is accepted, it is moved to the implementation team to build out the guidelines and procedures to operationalize the recommendation.

Therese Bonin can be contacted at

tbonin@mt.gov.

We asked Al Parisian, CIO and PBRI project sponsor, to discuss the PBRI Project and its Guiding Principles; he puts these into context:

“Montana State Fund’s current policy system (PHS) was implemented in 1997, and it has served the business well. But it is an old-technology policy system designed for simpler times, and it is generally just a policy system. Today our customers team developed a set of guiding principles. These Guiding Principles are guideposts to ensure that our daily decisions and actions do serve the long term success of policyholders and employees … that employers will have useful insurance options and our employees’ skills will stay current far into the future. With such a long-term project and long-range implications, our Guiding Principles Compass is an important constant reminder to us to keep all 360 degrees of our principles in mind with every decision we make.

“Together, we are building a platform that leverages our competitive advantage today and allows us to maintain it going forward. Our customers will enjoy better and easier to use insurance products, dealing with the best informed insurance staff possible. And we are doing this in the context of MSF’s own Mission, Vision, and Guiding Values.

“I want every employee and customer to know that whatever the future holds for MSF and the Montana Workers’ Compensation marketplace, PBRI will give MSF the tools to deliver the best service on current products with well-equipped employees.”

It’s that time of year again. Your service team is preparing to receive your July renewal and new business submissions.

We will begin to accept July 1, 2018 new business quotes starting March 1, 2018. Your Customer Service Specialist can assist with any questions you have regarding the July renewal season.

Report an Injury

Report an Injury Get Coverage

Get Coverage Manage Policy

Manage Policy Pay Bill

Pay Bill